Moats - Part 1

Does the company have a durable competitive advantage?

Dear Fellow Investors,

Welcome back! I’m Jay, a value investor, surgeon and PhD student. Apologies for the late article this week - life got in the way (I was on call at the hospital over the weekend).

Last week we we finished reviewing how to evaluate our understanding of a business (Or Meaning as Phil likes to call it). This is the first part of the investing framework that Charlie Munger has bequeathed to us via Phil.

If you missed that article or series, you can check them out via the links below:

Before we crack on with the next steps, let’s recap what we’ve covered so far just so that you’ve not gotten a bit lost (particularly if you’re a new subscriber). It’s important that you understand the concepts I’ve previously written about before you proceed as they provide the foundation for what we’re starting today.

1. A Touch of Narcissism

You learned why I started learning to invest in Origin Story Part 1 and Part 2. This is less important but may be useful for some of you if you’re trying to decide whether you want to start investing in the stock market yourselves (including why I prefer stocks to property).

2. Basic Financial Literacy

We covered The Origin of Money and Inflation, Compound Interest and Assets vs Liabilities.

3. The Irrationality of Mr Market

We discussed the origin of the irrational Mr Market, as well as why Mr Market behaves erratically. We concluded that as retail investors, we have the ability to take advantage of this foolishness to get rich.

4. Different Investing Approaches

We discussed conventional investing approaches and why value investors do not engage in them. Subsequently I gave you an overview of the value investing framework that Phil Town adapted from Charlie Munger and Warren Buffett.

5. Annual Reports and Financial Statements

I showed you where you can get financial data and how to read financial statements. The latter is crucial for the journey we are embarking on together.

6. Side Quests

I engaged in literary fellatio for Buffet’s birthday and introduced “cigar butt” vs quality investing to you. I also discussed one of the two companies I am actively investing into at present - Lululemon.

7. A Company Deep Dive [Ongoing]

We have started a deep dive into Lululemon, a company that is currently “on sale”. I have actively been buying shares and am using it as an example to teach you how to analyse a company using the frameworks that the legendary investors gave us.

We’ve covered the “Understanding” component over 3 articles using a checklist (links above), and this covers primarily a qualitative overview of the company and forces us to dig deep and ensure we’re not falling prey to greed, hubris and FOMO.

Today we’re diving into Moats aka Durable Competitive Advantage which is the second hurdle we must clear.

We have to deal in things that we’re capable of understanding.

And then once we’re over that filter, we have to have a business with some intrinsic characteristics that give it a durable competitive advantage.

And then of course, we would vastly prefer a management in place with a lot of integrity and talent.

And finally, no matter how wonderful it is, it’s not worth an infinite price. So we have to have a price that makes sense and gives a margin of safety, considering the natural vicissitudes of life.

It’s a very simple set of ideas, and the reason that our ideas have not spread faster is that they’re too simple! The professional classes can’t justify their existence if that’s all they have to say! I mean if it’s all so obvious and so simple, what would they have to do with the rest of the semester?

- Charlie Munger

This is where things get interesting because we start taking a qualitative and quantitative approach to our analysis. If you recall, I gave you a sneak peak at the checklist last week and hopefully you did your homework and made a start yourselves.

Before we get down to it, I need to give you the usual disclaimer. Remember, this is not financial advice. I’m not advising you or encouraging you to buy Lululemon. This is education and entertainment only. If you chose to copy me and lose money, that’s on you, not me.

Checklist Item #1 - What is the moat? Why is it durable and intrinsic? Is there more than one?

You may have forgotten all about moats since it’s been a while since we discussed them. Remember, a moat was the first line of defence for castle. The same principle applies to businesses.

I introduced moats to you here and stated that Phil et al taught me that there were 5 types of moats:

Brand Moat

Think of Coca-Cola and Google. They all have brands so strong that you intrinsically trust them. Why do you buy Coca-Cola instead of some generic cola drink at the bottom of the supermarket shelf? Why is the verb for doing any internet search called “Googling” (even if you’re using Microsoft Bing). Strong brands command customer loyalty and allows a company to charge a premium. The brand’s reputation becomes so strong that it’s difficult for competitors to replicate or challenge them.

Secrets Moat

A secret moat comes from a company’s exclusive intellectual property, such as patents, copyrights, or trade secrets. These protections make it legally impossible for competitors to copy their products or processes. Pharma companies have patents, Google and Open AI have trade secrets (their AI models are closed source) and Disney has copyrights on all their movies and characters.

Toll Bridge Moat

This moat is created when a company controls a unique asset or essential service that customers must use or that competition cannot easily acquire. These are often businesses with a natural monopoly or high barriers to entry. Think of rail roads, or certain utility providers (e.g. nuclear energy). They developed the infrastructure required for their business decades ago, when regulations were lax. Now that the bureaucracy has reached insane peaks, nobody else is able to cross that bridge. At least not without significant costs that are often prohibitive. Nobody is building new railroads now. Look at the failure of HS2 in the UK. We can’t even build a new runway at Heathrow either.

Switching Moat

This is when it is incredibly costly or difficult for a customer for a customer to switch to a competitors products. Think of Apple’s “walled garden” ecosystem. Or Microsoft’s enterprise solutions (a stranglehold on most businesses).

Network Effects Moat

A network effect occurs when a product or service becomes more valuable as more people use it. This creates a powerful self-reinforcing loop that makes it very difficult for new competitors to gain traction. Meta is a perfect example of it. Want to share photos of your beach body with friends and family? You have to be on Instagram or Facebook. Want to message people? You have to use WhatsApp. Why? Because all your friends and family are already there.

Price Moat

This moat is based on a company’s ability to offer a product or service at a significantly lower price than its competitors. This is typically achieved through economies of scale, superior manufacturing processes, or an efficient supply chain. Think of Walmart/Costco in North America and Aldi/Lidl in the UK.

So…

What type of Moat does LULU have? And how do I know this?

Well for starters - I know the moats because as a customer of the company, I understand the products and the moat. However, you may recall that my interest in investing in the company is what actually led me to become a customer.

So how did I discover the moats before I became a customer?

I looked it up.

Duh.

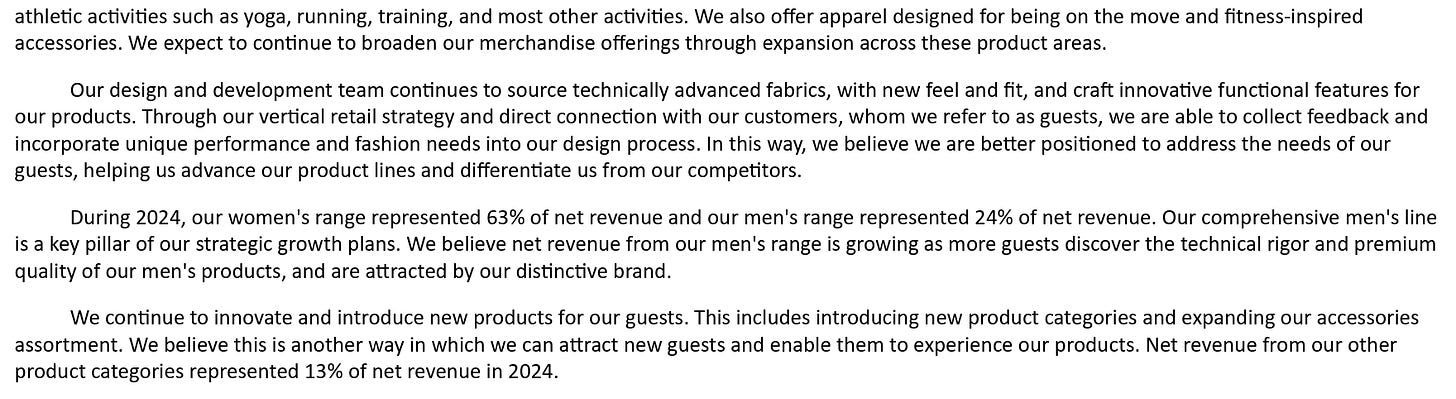

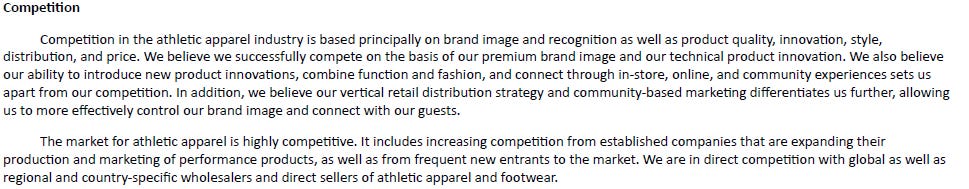

Remember the Annual Reports/10Ks? You do need to actually read them. If you’ve forgotten how to access the information you can go back to this article, and this one tells you how to read them.

Management literally tell you why their business is successful and are able to fend off threats to the business in a highly competitive market.

This is why I previously highlighted that reading the business section of the 10K is essential. You can also find additional information on their Investor relations site as well as through general Googling/AI.

So what do we know about their moats?

1. Brand Moat

This is their most obvious moat. It is clearly powerful. They have a premium aspirational brand that is centred on wellness and an active lifestyle. They demonstrated over decades that they are able to charge premium prices for their brand. Because of their first mover advantage, quality athleisure is is intrinsically associated with their brand.

2. Secrets Moat

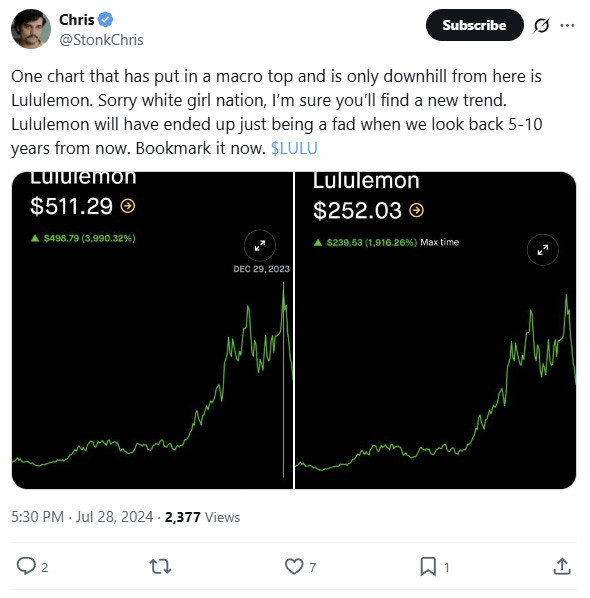

Most people seem to think that the brand is all the company has. That it’s simply a fad.

But the reality is that LULU’s got a fantastic secrets moat. Along with the design and appeal of the clothing, the proprietary fabrics used are unique to the company. While competitors can copy the “look” of LULU products, they have so far struggled to copy the “feel” (more on this another day I promise.)

“ We are not an athleisure company like the others. We are a fabric company. The material is just better. Go try our ABC pants and you’ll see”

- A store manager

This is what one of the managers in store told me when I picked his brains about the company and the competition. And you know what, I tried the ABC (anti ball crushing) pants and I believed him. They really do have superior fabric, and its not just for fitness. The ABC line is suitable for smart casual and formal wear too with different fabrics for each occasion.

When I now go shopping at LULU, I actually look to see what fabric is used prior to to buying a product for me or my wife. For example my wife’s leggings and jacket use a fabric called Nulu.

The summer ABC pants I have use WovenAir, while the autumn ones use Warpstreme. If I want them to look more formal, I could go for the VersaTwill instead of Warpstreme.

My License to Train line of gym wear from LULU use Silverescent technology to manage my sweat and stop me stinking the place up (sadly it has no impact on my protein farts, so I still continue to stink the place up).

Management touch on the power of their proprietary fabrics in their 10K (see earlier screenshot), but they don’t delve into detail. But don’t worry, I’m more than happy to unleash my autism and tell you all about it.

Women’s Fabrics

Nulu (My Wife’s favourite)

Feel: Buttery-soft, lightweight, and often described as having a “next-to-nothing” or “naked” sensation.

Best for: Low-impact activities like yoga, as well as lounging and casual wear.

Key Products:

Align Collection: This is the flagship product line for Nulu, including the famous Align leggings, shorts, and tops. Its unmatched softness and comfort make it a customer favourite for yoga and everyday life.

Luxtreme

Feel: Smooth, slick, and cool to the touch with moderate compression.

Best for: High-performance, high-sweat activities like running and training. It’s known for its excellent shape retention.

Key Products:

Wunder Under Leggings (Classic version): This was a staple legging for many years and was known for being a versatile, all-around workout tight. While it has been largely replaced by the Wunder Train in some markets, it remains a classic example of Luxtreme’s use.

Fast and Free Leggings (some versions): While the primary fabric for this line is Nulux, some earlier or specific versions of the Fast and Free line used Luxtreme, especially in areas needing more support.

Everlux

Feel: A unique combination of a sleek, low-friction exterior and a soft, comfortable brushed interior. It is designed to be the fastest-drying fabric.

Best for: Hot, sweaty studio workouts like spin, hot yoga, and HIIT, as it keeps you cool and dry.

Key Products:

Wunder Train Collection: This is the most popular collection using Everlux. It’s designed for high-intensity workouts and is known for its quick-drying properties and supportive feel.

Invigorate Leggings: Similar to the Wunder Train, the Invigorate line is also known for using Everlux to support intense, sweaty training sessions, often featuring side pockets.

Nulux

Feel: Silky-smooth and ultra-lightweight, with a “barely-there” feel similar to Nulu, but more durable.

Best for: High-impact, high-speed activities like running, where you want a smooth, light feel without the friction of other materials.

Key Products:

Fast and Free Collection: This is the signature line for Nulux. The leggings and shorts are designed for runners who want a lightweight, distraction-free experience. The fabric’s low-friction surface and excellent stretch make it ideal for long strides and fast paces.

Luon

Feel: Lululemon’s original cottony-soft fabric with a gentle, supportive feel. It’s breathable and has a four-way stretch.

Best for: Low-impact activities, casual wear, and to-and-from wear.

Key Products:

Define Jacket: This iconic jacket is famously made with Luon. Its structure and soft feel make it a popular layering piece.

Wunder Under Leggings (Luon version): The original Wunder Under legging was made with Luon, offering a cozier, more supportive fit for yoga and everyday wear.

By tailoring each product line to a specific fabric, Lululemon creates a clear value proposition for the customer, helping them choose the right gear for their specific workout or activity.

Men’s Fabrics

Warpstreme

Feel: Soft, smooth, durable, and highly versatile. It’s engineered to feel like a high-end chino or work pant but with the performance of athletic wear.

Best for: Everyday wear, office, travel, and a “commute to workout” lifestyle. It is wrinkle-resistant and offers four-way stretch.

Key Products:

ABC (Anti-Ball Crushing) Pants: This is Lululemon’s most famous men’s product. The ABC pants use Warpstreme to provide a comfortable, flexible, and polished look that can be worn in the office or on the go.

Commission Pants: This line, which is now often merged with the ABC collection, also uses Warpstreme for a classic trouser look.

Swift

Feel: Lightweight, smooth, and low-friction with a subtle two-way stretch. It’s designed to be a “barely there” feeling for high-speed activities.

Best for: Running, training, and sports. It’s highly breathable and quick-drying, making it a go-to for hot weather or high-sweat workouts.

Key Products:

Pace Breaker Shorts: These are a staple for men’s running and training. The Swift fabric allows for a full range of motion without feeling restrictive or heavy.

Surge Shorts: Another popular running short that often uses Swift, offering a lightweight and fast-drying experience.

Silverescent Technology

Many of the items in the License to Train and Metal Vent Tech line are made with a specific fabric that incorporates Lululemon’s Silverescent technology.

Primary Composition: This fabric is usually a seamless blend of recycled polyester, nylon, and elastane. It’s often a lightweight mesh for breathability.

Key Function: The technology uses silver-coated threads (powered by X-STATIC) to inhibit the growth of odor-causing bacteria on the fabric. This keeps the shirts from smelling, even after multiple intense, sweaty workouts.

WovenAir (My new ABC trousers for summer)

Feel: A very lightweight and breathable fabric with a mesh-like texture that feels more casual than Warpstreme.

Properties: Offers four-way stretch, is water-repellent, and dries quickly.

Used for: Casual and travel-friendly trousers, joggers and shorts where maximum airflow is desired (i.e. keep my balls cool in summer).

VersaTwill

Feel: A more structured, canvas-like, cotton-blend fabric that feels similar to traditional chinos.

Properties: Has four-way stretch and is quick-drying.

Used for: Business-casual and everyday wear in items like the ABC Pants, where a more polished and less “techy” look is preferred.

As an investor do I need to know about every single one of these fabrics? Nope. I don’t know all of them that well even as a customer (I obviously looked some of them up). But I know what I like and look for those items whenever I go shopping there. Once I discovered how good the products felt, I just kept coming back for more.

A 2nd Secrets Moat?

Aside from the high quality proprietary fabrics, there is a second secrets moat that I think is somewhat weaker and underutilised. But it certainly has the potential to be strengthened.

That is Data.

As I mentioned previously when discussing Netflix, data on your customers is critical.

Lululemon should have high quality data on it’s customers given it primarily does direct to consumer (DTC) sales. It means they can collect more data on consumers and determine what they want earlier than a competitor that uses third party franchises and wholesale partners who won’t share that data readily with Lululemon. This informs branding, marketing and new designs.

However, I would argue that this is a relatively underutilised asset of LULU’s. This is because despite having decades of data, they’ve still fallen behind the curve on recent trends and allowed Alo to take the lead with marketing and appeal. These mistakes were owned up to in the recent earnings call, and it would appear they are taking steps to rectifying this. One of these steps includes hiring a new AI and technology officer who has the potential to help the company predict and customer needs and trends. But lets not get ahead of ourselves as this is all conjecture at this point. This move has yet to bear fruit.

Any Other Moats?

Unlike Netflix, Meta or Google, unfortunately LULU does not have any more moats (at least in my opinion).

There is no switching moat, as it is relatively straightforward for many Lulu customers test and try out competitors such as Alo. In fact, Alo opens stores near Lulu stores to try and steal/capture market share. A true switching moat is something like Apple’s walled garden ecosystem.

There is no Network effect - you are not forced to use the brand’s products just because others use it. A true Network effect moat would be Meta’s social media platforms.

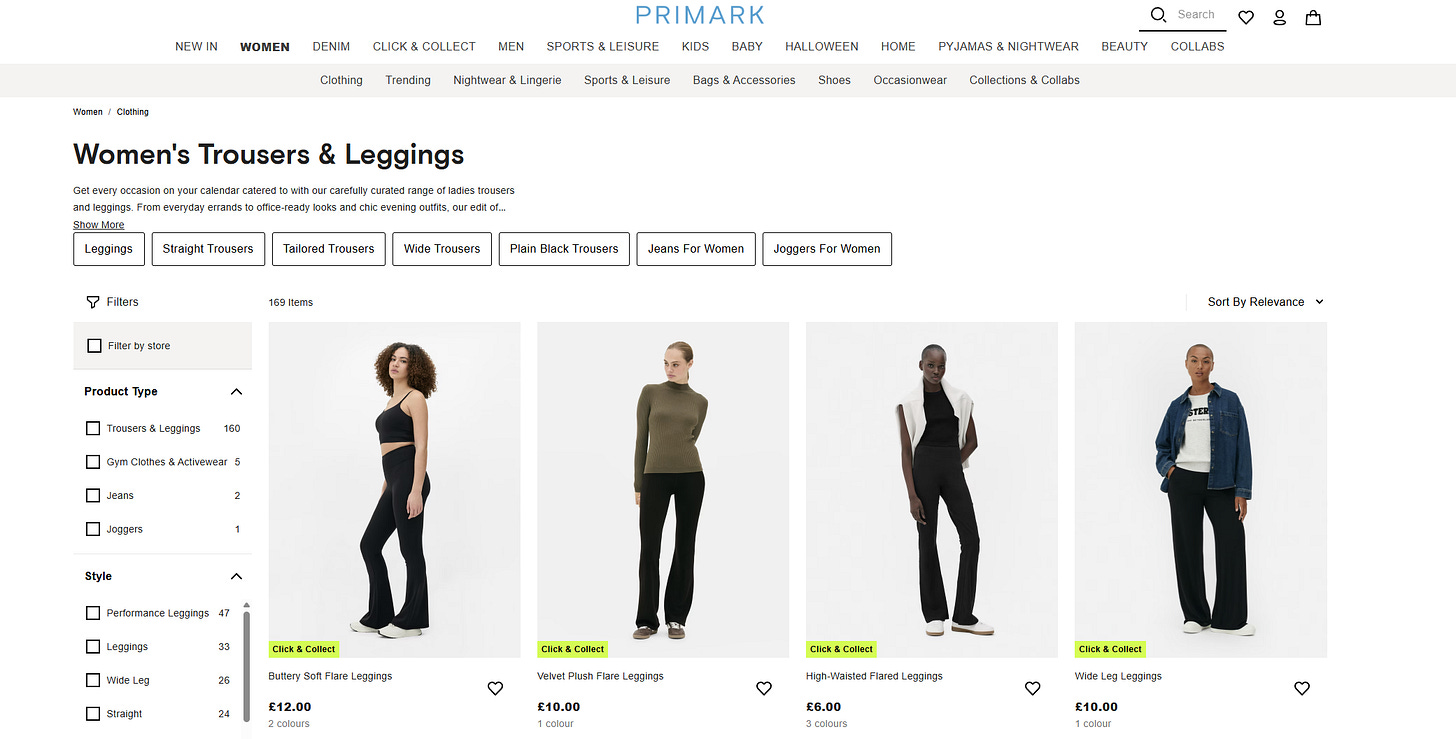

There is no toll bridge. While it does take a lot of time and effort to make products to the same standard as Lululemon (quality fabric and style), technically any random competitor can start selling leggings that look vaguely similar. They just have to source some generic crap from Vietnam or China and sell it online. The difference is their design, quality and customer service will naturally be poorer. Given that LULU haven’t made optimum use of their decades of data, it is clearly not a toll bridge moat. However, this may change in the future.

And this brings me to the final point. Lululemon are not a low cost producer. Their custom fabrics cost more. Their quality control process is rigorous and more costly. So while the likes of Costco and Primark are low cost producers and sellers, LULU is not. However, despite the higher cost of production, LULU has clearly superior margins.

Conclusion: Good. There is more than 1 moat, and the second moat has the potential to be strengthened and used to develop a toll bridge. But whether or not that happens remains to be seen.

Checklist Item #2 - Is it hard to compete? Are there barriers to entry?

Sadly, there is no major barrier to entry when it comes to producing athleisure products. The market is highly competitive and the reality is there are so many brands out there, including dupes/copies being sold on Amazon, Primark, Costco etc, that I simply can’t keep track of them all (feel free to do some Googling).

In fact there are even video guides on how to find dupes in shops such as Costco and Lululemon has recently filed a lawsuit against them.

As I see it, price sensitive customers are less likely to buy Lululemon leggings in the first place and will settle for second or third tier brands like Costco or Primark. Meanwhile, middle class spending habits will be variable in nature. Upper echelons of the middle class will be relatively price insensitive, but many of the aspirational middle class who are trying to climb the ranks (e.g. my wife and I) will be cautious with their spending.

However, price insensitive customers (upper classes and the truly rich) are unlikely to settle for anything less than quality. Thus, I’d argue that any difficulty with competing against LULU stems from a competitor’s inability to steal loyal affluent customers because they lack the brand and quality fabric. Most customers of the low end competitors are unlikely to have become true LULU fanatics in the first place given their focus on price over quality.

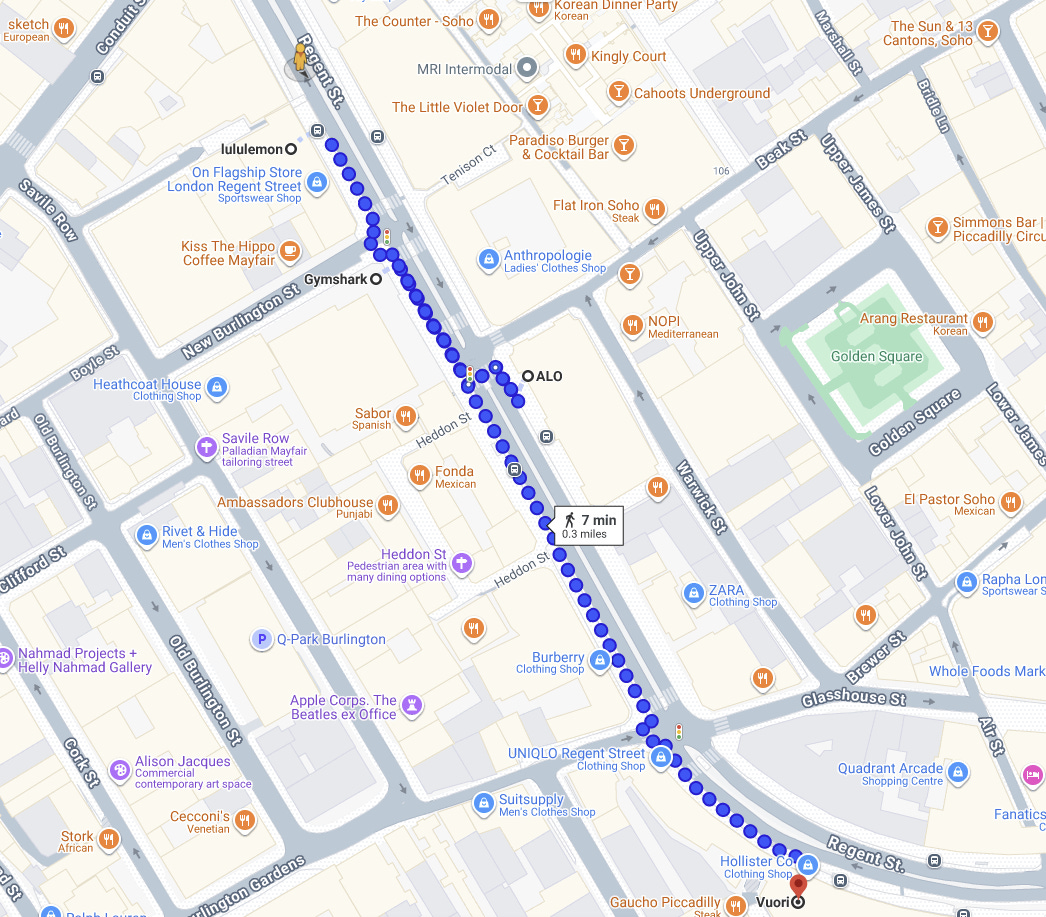

This is something I confirmed when I grilled the store managers in both Canary Wharf and Regent Street in London. While discretionary spending slows down in all other retail stores during economic downturns, they said there was zero slow down in sales during the 2022 inflation crisis. The stores continued to have high footfall and there was no major drop in sales. One employee stated:

“Our customers are different, they’ll just keep buying”.

Conclusion: Neutral. I’d prefer it if the company was harder to compete against. But despite the intense competition, LULU are still doing very well.

Homework

Let’s pause here today and continue with the moat checklist next week (remember this is going to be a long multipart series). We’ve now covered the qualitative aspects of moat assessment, and now we’ll be starting the quantitative approaches.

This means you need to revise the analysis of financial statements again because we’ll finally be crunching some numbers.

Be a good student: Like, Share, Subscribe and do your homework. I’ll see you next week!