Dear Fellow Investors!

Welcome back to another weekend of education. I’m Jay, a surgeon, PhD student and investor here to democratise and demystify the world of investing and finance for you.

Last week we discussed inflation and its impact on the buying power of your money.

Here is the link to the article in case you missed it.

I hope you did your homework and enjoyed Ray Dalio’s highly informative videos. You should now have learned and understood how both the economy, and geopolitical power fluctuate in cycles. You should also now know the role of central banks in controlling interest rates and money supply. Understanding these concepts is key for your investing journey and if you’re struggling, leave a comment below and I’ll help you out.

I concluded last week by stating that the way to address inflation is to invest in inflation beating assets. The severity of inflation’s impact on the value of our money is due to compound interest. If you’re able to truly understand its power, instead of being disadvantaged by it, you can use it to become incredibly wealthy. How? You put your money in assets, not liabilities.

So the two areas I was supposed to focus on today are:

Compound Interest

Assets vs Liabilities

Unfortunately, while discussing compound interest, I veered off on a tangent regarding UK Investment Savings Accounts (ISAs). I know many people in this day and age have limited attention spans, therefore we will be deferring our discussion on Assets and Liabilities for next week.

Before we begin, first things first. Once again I must remind you, this is not financial advice. If you want financial advice, go to a qualified financial advisor. I am simply a random surgeon on the internet, offering education and entertainment only.

Let's begin.

Compound Interest

Interest can be earned in two forms, compound and simple. Many of you may vaguely recall learning about this in school, but likely don't fully grasp the implications. I have had many surprising conversations with colleagues (both senior and junior) and family, who are making serious errors with their personal finance, as they lack an understanding of this basic concept.

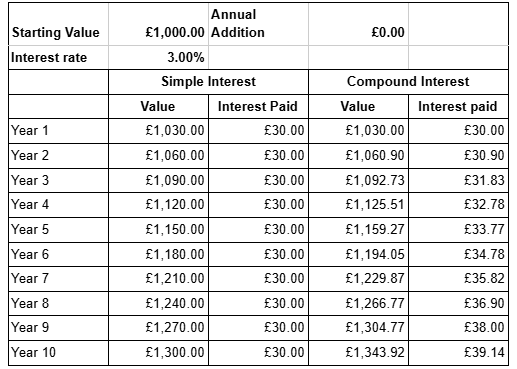

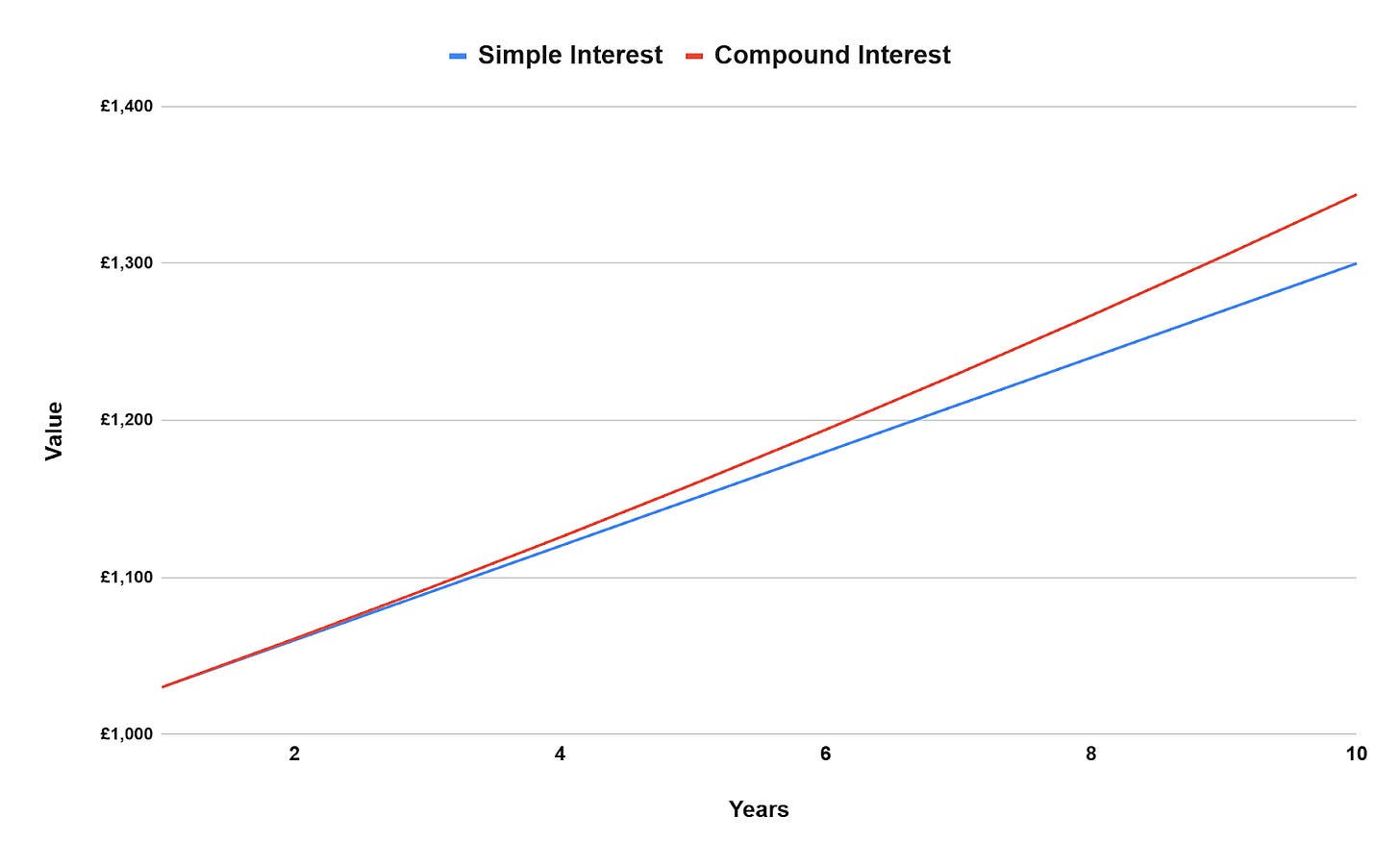

Let’s start with a somewhat unrealistic scenario first, to ensure you really understand this. Say I save £1k in Bank A and £1k in Bank B. I add nothing more to the account and let the money sit for 10 years. Bank A pays me simple interest at 3% while Bank B pays me compound interest at 3%. How does this play out over 10 years?

If you were making simple interest over the 10 years, you simply earn 3% of the original amount every year. So in this case that’s £30 a year for 10 years. However, if you were earning compound interest, the amount of interest paid each year increases. Why? Because you’re earning interest not just on the principal, but also in the previously earned interest.

This results in you having an extra £43.92 at the end of the 10 years.

You may be wondering, what’s the big deal? It’s only an extra £40 right? Well, when you start adding money every year, or even earn higher interest rates, this leads to a powerful snowball effect. Generally speaking the more money you invest and the higher the interest rate, the higher the return. But the opposite is also true.

"Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it."

- Albert Einstein

When you get into debt (credit card, student loan, mortgage etc), you are paying compound interest. This is how banks profit off you. I currently owe £1k on my Amex Platinum card which carries a 30% interest rate. If I pay it off in full at the end of the month, I pay no interest. But if I don’t pay it back, I’ll owe an extra £300 in interest alone!

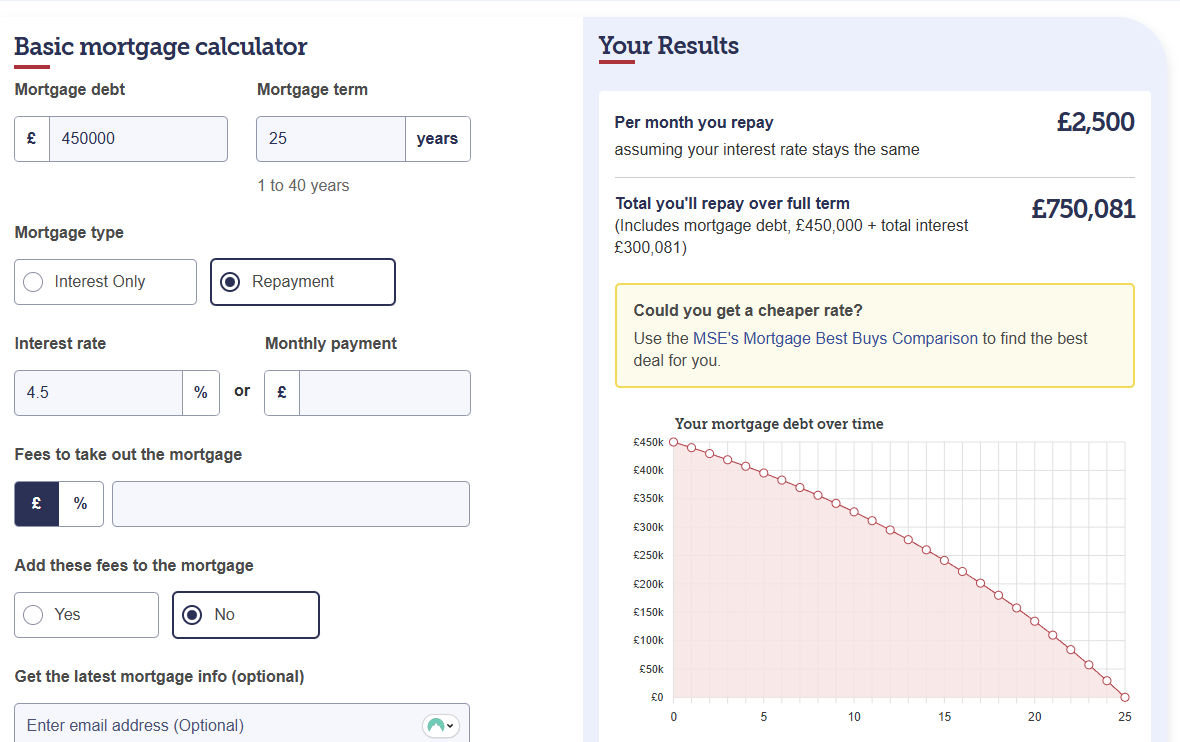

If you take out a 25 year mortgage of £450k to buy an expensive home in London, you could be paying £300k in interest alone!

The Banks understand compound interest. That’s why they earn it off you, the unsuspecting public. But if you finally grasp the concept, you can minimise how much you pay, and instead maximise how much you make through compounding.

An Introduction to ISAs

I’d like to elaborate more using UK ISAs (Investment Savings Account) as an example. (If you’re American, these are like your Roth IRA). If you are a non UK resident, you can probably skip the rest of this article as you are not eligible for these accounts, it’s somewhat irrelevant for you. But if you live in the UK, I’d urge you to stay and read on instead of jumping onto your Instagram reels or TikTok.

In the UK there are 3 main types of ISAs that the average citizen can invest in:

Cash ISA

Life-time ISA (LISA)

Stocks & Shares ISA (S&S ISA)

There are two others - the innovative finance ISA (for sophisticated investors to lend money, not really something you or I would be doing) and the junior ISA (for parents to invest money for their kids). But let’s focus on the big 3 for now as they are the most accessible and most relevant for us.

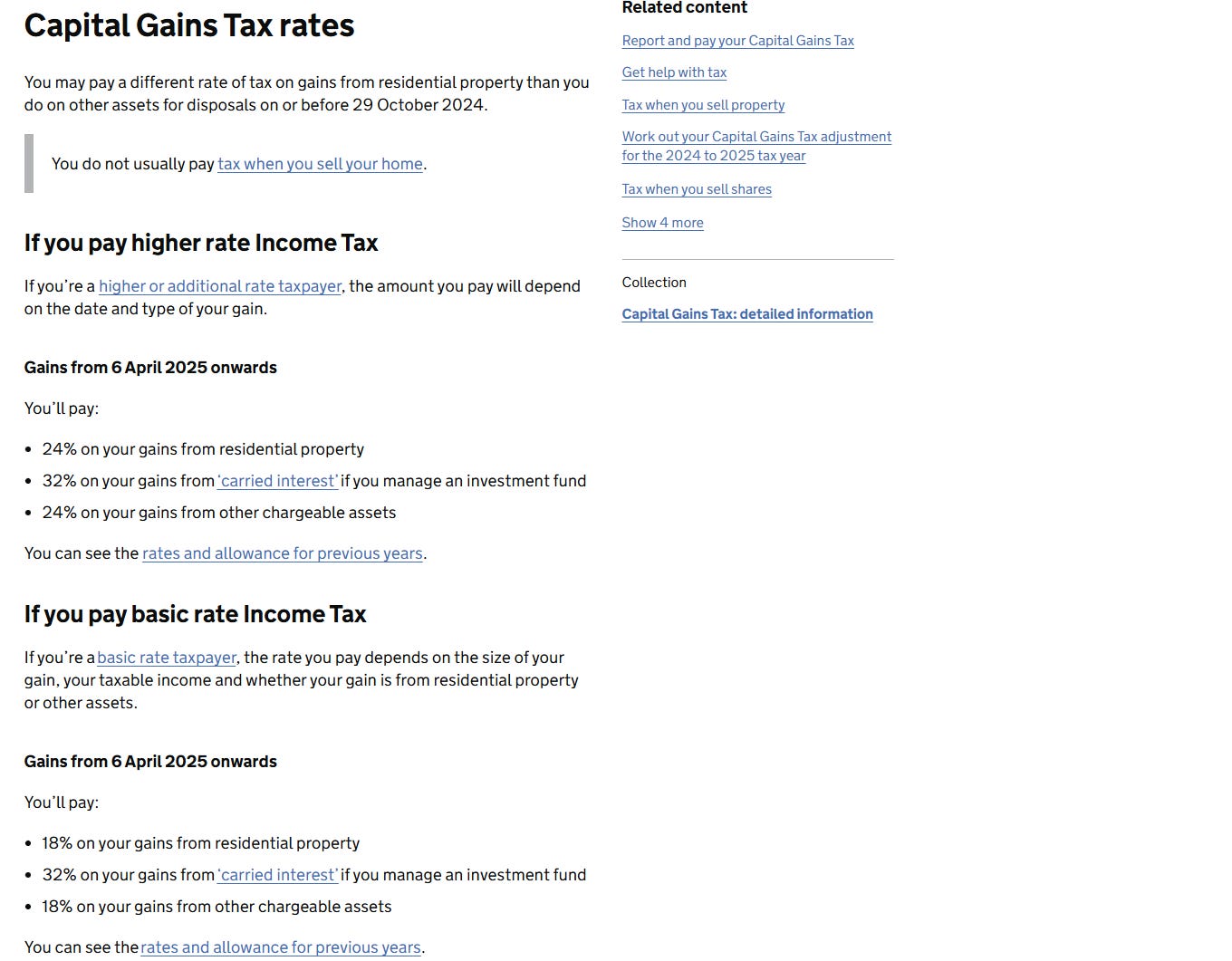

An ISA (or the Roth IRA) is a special type of account where any gains made are not subject to capital gains tax (tax on savings or investment income, this is a different rate to income tax which is what you pay on earnings from your job). Different countries have different rates of tax.

In the UK, capital gains ranges from 18% to 32%. In the USA this is 0% to 28%.

"Nothing is certain except death and taxes"

- Benjamin Franklin

In the UK, you are able to save or invest £20k into an ISA and not pay a single penny in tax on any of the gains made. Over your lifetime, this can result in significant tax savings.

A Cash ISA is basically a savings account where you don’t pay tax on the interest earned. In 2025, most UK Cash ISAs are paying on average 4% interest rates (This is Money - UK Cash ISA Accounts). These have of course been much lower prior to the recent inflationary crisis, and the rise in interest rates (you should know about this from my previous article and the Ray Dalio videos I suggested you watch). Prior to 2023, some accounts were offering 0.1% insult rates.

A LISA is a special form of ISA designed to help individuals save for their first home or for retirement. It comes with a 25% government bonus on deposits up to £4k (i.e. if you deposit £4k, the government will give you an extra £1k. But if you deposit anymore than that, they will not give you any further bonuses). This 25% bonus is Simple Interest. The maximum bonus you can receive in any year is £1k.

Most of these accounts only come in Cash ISA form. You then receive the standard cash ISA interest rate - currently approximately 4% and this is compounded annually. You can only open one between the ages of 18 and 39. There are also withdrawal restrictions, you can only withdraw the money after the age of 60 or if you’re using the cash to buy your first home. Otherwise you incur a 25% penalty on your withdrawal.

A S&S ISA is simply an account that allows you to invest in stocks (more on what a stock actually is when we discuss Assets vs Liabilities next week). Your rate of return depends purely on what you invest in. You can invest in funds or pick individual stocks like me. Funds can be actively managed (someone else is picking the stocks) or passive index funds (typically the top countries in a region or country).

The S&P 500 is an index fund (also known as an electronically traded fund - ETF) that represents the top 500 companies in the USA. It has a historic annual return of 10-12%. Most people these days invest in the S&P 500. I don’t. I pick individual stocks and have made an average annual return of 24% (see origin story articles).

So let us compare these 3 products using what we’ve learned about compound and simple interest.

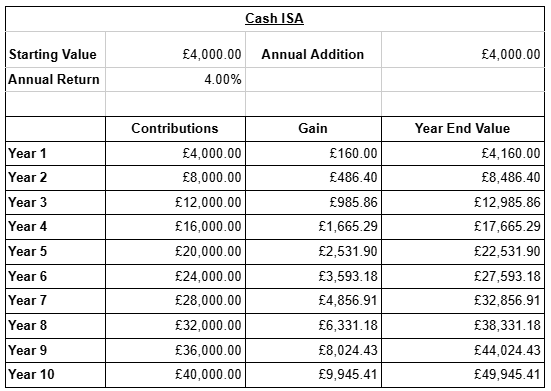

First the Cash ISA: let’s assume you save £4k a year for the next 10 years and are earning 4% compound interest, how does this play out?

Over 10 years, you’ve contributed £40k and made an extra £9.9k in tax free gains leaving you with £49,945.41. Not bad, that's a 25% return.

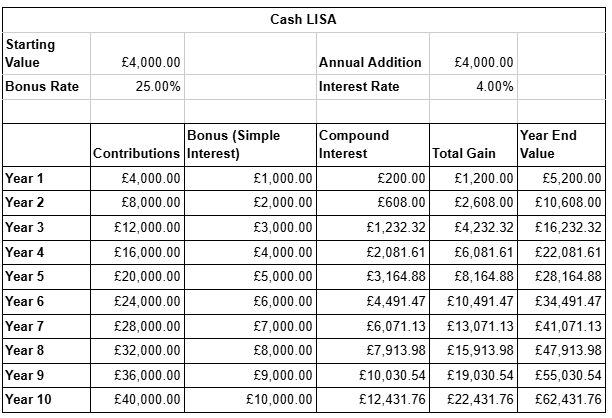

Next, the LISA. Here you get a juicy 25% bonus on your contribution (up to £1k remember) + a further 4% compound interest. How does this play out?

This is much better! You’ve still contributed 40k over 10 years. But you’ve made £10k through the government bonus (25% simple interest) and a further £12.4k through 4% compound interest. This leaves you with a gain of £22k at the end of the 10 years and final value of £62k. This is a 56% profit on your savings, and all tax free. But note this, the supposed 25% bonus rate only produces £10k in returns, while the measly 4% interest rate produces £12k in returns?

Why?

Because Compound Interest is King. Simple Interest is Trash. Remember, compound interest has a snowball effect whereby you gain interest on old interest. This doesn’t happen with simple interest.

But what happens when you put the money in a S&S ISA? You don’t get that £1k a year government bonus (25% simple interest). So does that mean you’re losing out?

No.

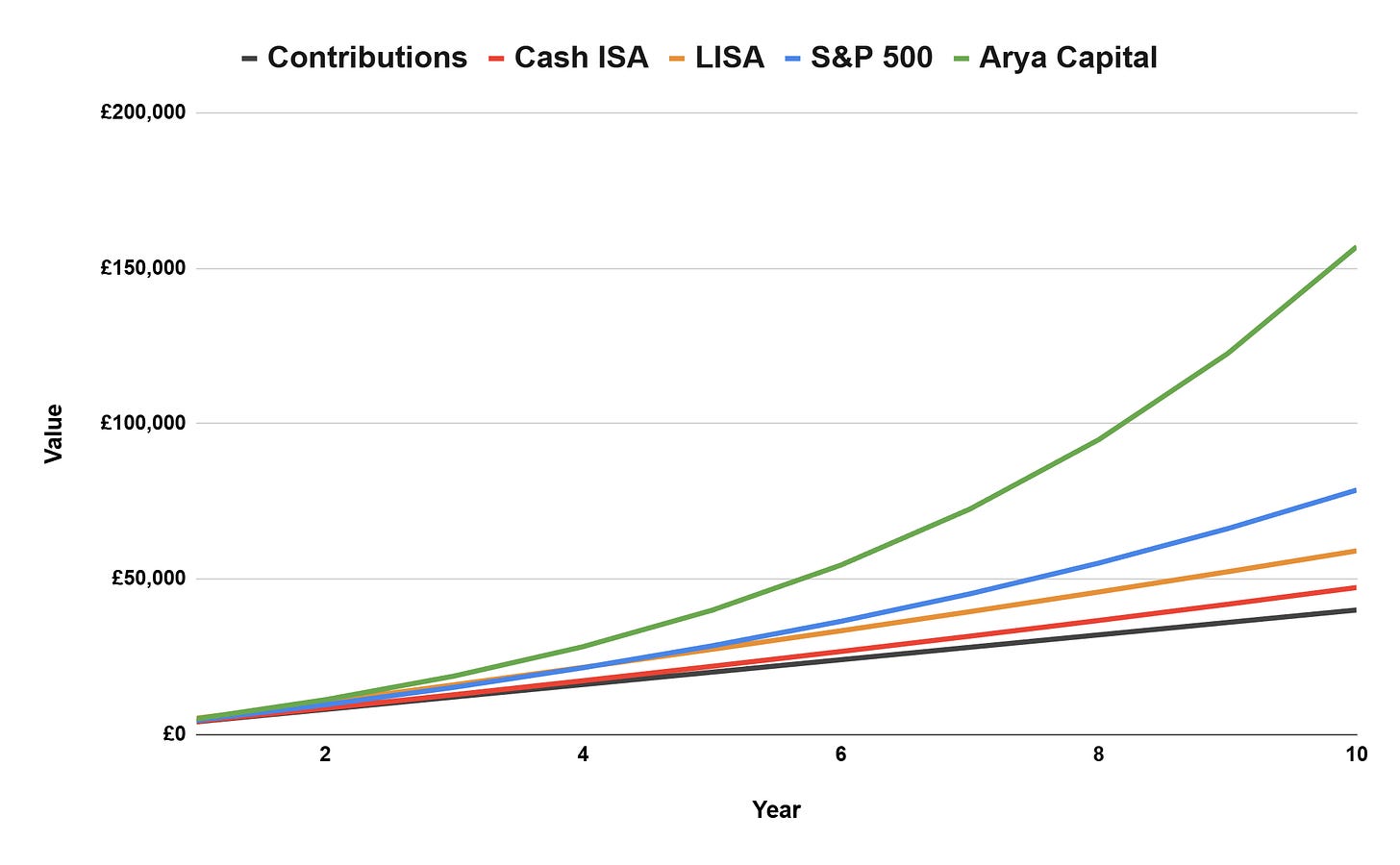

Let’s assume you invested your money in the S&P 500 and made an average annual return of 12% (compound interest). What happens now?

You’ve made £30k and are left with a total of £70k at the end of the 10 years - this is a 97% return. Even without the government bonus - you’ve outperformed the Cash LISA. Why? Because the government bonus of 25% is capped at £1k, and is only simple interest. Not compound interest. Let me say it once again, Compound Interest is King, Simple Interest is Trash. You’re only making 4% compound interest in a Cash LISA while the S&P 500 gives you 10-12%. Simply by participating in the stock market, and getting a higher rate of compound interest, you’ve done far better.

But what happens if you invest like me? Remember, I’ve been making 24% a year on average.

This would leave me with nearly £157k at the end of 10 years. £117k of pure untaxable profit. That's an absolute return of 292% (yeah I know, I’m awesome).

Let’s graph this out just to really hammer this point home.

This snowball effect increases with not only your rate of return, but also the amount you invest. If you invest £10k per annum instead of £4k, and continue making 24% a year, this is what happens.

Furthermore, while you can continue getting obscene rates of return in a S&S ISA, your LISA 25% bonus rate is still capped at £1k a year. Which means even if you add more money to it, you won’t earn compound interest at rates higher than 4 or 5% at best. You simply can’t build a significant snowball with it.

Remember. When you invest, each $ or £ has a specific job to do: to bring in more money. The more money you deploy on this mission, the greater the return.

So what have we learned? Compound Interest is King. Simple Interest is Trash. Investing in Assets (e.g. stocks) is best. In the long run Sitting in Cash is Trash due to Inflation (there are benefits to this in the short term and I’ll explain why at a later date).

Don’t Forget Inflation

But wait! We forgot to account for inflation in our returns. Remember, the value of your money is constantly being eroded with yearly inflation!

Over the last 10 years, inflation has averaged 3.4% in the UK (ONS Data). It was far lower than that initially, and then much higher in the 2020s thanks to the money printing (see last week’s article).

If you kept your money in a current account or under your mattress over the last 10 years, you'd have a negative 17% return. Yes that’s right, by doing nothing with your money, you are actually losing money every year! Arya Capital would have generated 279% after inflation.

If you had a Cash ISA paying you 4% a year consistently then you would have just about beaten inflation and made a small return of 20%. But remember, most ISAs did not actually consistently pay 4%. This is just the current average rate and for most of the last 10 years, banks paid you an insult rate of 0.1%. Therefore this chart likely overestimates the earnings power of a Cash ISA or LISA, as central banks have started cutting interest rates again. This means these accounts probably won’t continue paying these same rates very long.

However investing in the stock market, particularly the value investing approach ensures you definitely have a healthy margin. Not only do you crush inflation if you buy the S&P 500 (10-12% annual returns), you actually stand a chance of growing your wealth with Buffett style value investing (my annual return of 24%).

A Little Disclaimer on LISAs

Now before I get accused of being disingenuous or glib, I must confess to something I left out earlier.

There are some LISA’s that allow you to actually invest your money in stocks or funds. This is a relatively new phenomenon and the number of platforms that let you do this today is higher than when I first started investing (non-existent back then). This is why I did not actively include these in the comparison above - I simply didn’t have the option to do this back in 2020. So theoretically now in 2025, you could invest in a LISA where you get both the 25% simple interest bonus rate and the higher rates of returns that come with stocks. But they are hard to come by - most platforms and banks do not offer this. And those that do, often limit you to funds rather than individual stocks. Furthermore, fees on many S&S ISAs are lower than the investment LISAs.

For example I use Trading 212’s S&S ISA and I pay no platform fees and no commission on investments (aside from a 0.15% Forex fee for foreign investments).

The cheapest LISA platform is Dodl by AJ Bell (I only discovered them today when writing this article). They charge a 0.15% platform fee and 0.75% Forex fee. Despite being relatively low, these costs add up, especially when your portfolio starts to grow larger. Furthermore, I do not like the government’s restrictions on when you can withdraw money from the LISA and the risk of incurring a penalty. I want the freedom to do whatever I want, whenever I want with my money (I really don’t like being told what to do by other people). Therefore, due to reduced costs and increased freedom, I shall probably still be sticking with my S&S ISA rather than switching to an Investment LISA. This is especially because my 45% pay cut to pursue a PhD means that I am currently living pay check to pay check, I don’t have spare cash to invest (so much for financial responsibility huh). In fact, I haven’t contributed to my S&S ISA at all in over a year . However, if my personal circumstances change, I may reconsider an investment LISA in the future.

Why I’m Pissed Off

You may recall that in 2017, when I commenced on my investing and personal finance journey, I budgeted and made lifestyle adjustments to scrimp and save as much money as possible. After putting together a healthy emergency fund, I started to put all my spare cash into my S&S ISA from 2020 onwards and invested it.

However, when discussing this with friends and colleagues, I was shocked to find that most people put their money in a Cash ISA. Some of my more savvy colleagues put their money in a LISA. But when I debated that a S&S ISA was better, they questioned my logic.

“Don’t you know that the Cash LISA pays out a 25% bonus? That’s much better than your Stocks and Shares no?

- A Consultant Surgeon (back in 2020)

“Aren’t stocks risky? The Cash ISAs are safe, I’ll won’t lose money!”

- A PhD Colleague (a couple of months ago)

Sadly, the situation throughout the UK is quite grim. Many don’t grasp the power of compound interest or inflation and when I bring the topic up with friends, family and colleagues I’m often greeted with blank stares. It upsets me even more when they pretend to know more than me, or think I’m a fool and make snide remarks for my approach to personal finance.

It is incredibly frustrating sometimes. I want to scream, shout and berate them in an attempt to convince them to listen to me. But then the words of a wise woman echo in my head and I find the will to resist the urge.

“Jay! You need to control your autism! Think about people’s feelings before you speak.”

- My Wife (she is incredibly wise)

And so here I am in my own little corner of the internet, trying to educate everyone and being considerate of their feelings.

But the situation is no joke. HMRC statistics released in 2024 account for ISA data up to the end of 2022-2023 tax year. They paint a bleak picture.

The number of Cash ISA accounts vastly outstrips the number of S&S ISA accounts. This is despite the potential of higher returns in S&S ISAs, and the risk of inflation completely eroding the value of your deposits in a Cash ISA.

This is strongly reflected in the actual values of the holdings within ISAs. Despite more money being deposited into Cash ISAs (£41million vs £28million), the market value of Cash ISAs is just under £300million while it is £430 million with S&S ISAs.

Education is Needed

A couple of years ago, a deluge of memes and articles mocked Rishi Sunak’s attempt to improve numeracy in our population.

Honestly, I felt that it was commendable for him to try. Everyone is happy to take jabs at him or his wife for being rich. But do you know why they are rich? Because they understand compound interest. Because they invest in assets such as stocks. And because they know how to take advantage of products such as ISAs.

I would argue that much of the inequality in the UK stems from a lack of numeracy and financial education. If the general populace e.g. you and I, were actually properly educated on these matters, we’d all be investing. Instead we’re happy sitting on the side-lines in our crappy Cash ISAs, and not participating in the wealth creation process that capitalism offers. We then cry foul when people who took the time and effort to learn investing eventually become wealthy.

I find this victim mindset greatly upsetting. Blaming rich people for figuring out the system and maximising its utility doesn’t improve your life or increase your wealth. Using the same tools and getting educated on the matter does improve things. Even if we try to tax the ultrawealthy to oblivion, they simply have the option to leave the country and take their wealth with them. That means the government will need to tax us normal folk more.

It’s Not Your Fault. But It Is Your Responsibility

It is not your fault if you started off financially disadvantaged. It is not mine or my wife’s fault that her family had poor finances or that doctor’s pay and conditions have deteriorated significantly. But it was our responsibility to sort our lives out. We took ownership and we figured it out, because nobody was coming to save us. My wife has large student debts from her two degrees. While hear loans covered fees, I supported her living costs through medical school on my single income. And this was constantly being eroded by inflation over the years.

Despite this, I have managed to significantly exceed the average market value of an ISA for my age group. I worked hard to save, and I invested wisely once I educated myself on how to do so.

You could argue that I am privileged because I am a doctor, I do earn a little bit more than the average UK population. But there are also plenty of doctors who come from better financial circumstances (dual income household, no responsibility to support family members). There are also many engineers, lawyers, finance professionals, management consultants, accountants etc who make more than me. Yet they have less in savings and investments than me, with far lower rates of returns, despite some of them having actual economics and finance backgrounds.

“The chief task in life is simply this: to identify and separate matters so that I can say clearly to myself which are externals not under my control, and which have to do with the choices I actually control.”

- Epictetus

There is much in life that you cannot control. And there is very little you can do about it. Instead you must identify what it is you can control and do to improve your life. Compound interest doesn’t just apply to your finances. It applies to your skills, knowledge, health and wellbeing. Every gym session, every weekend spent reading and learning, every healthy meal. All these decisions compound. You may not see the results immediately (I certainly saw none between 2018 and 2023), but eventually the snowball effect will kick in and you’ll look back and see how much you’ve grown. Financially, physically and spiritually.

And so, because I’m a massive nerd and need to remind you of it regularly, I’ll end with this quote from the very first Pokémon movie.

Homework

Last week I gave you two YouTube videos to watch.

Today I’d like you to watch this video by Damien.

He’s got an excellent YouTube channel that focuses on personal finance in the UK. He’s not so big on actually teaching you how to invest (don’t worry, that’s where I come in). But he’s very good at educating you on tax, budgeting, finance, and how the various shenanigans of our politicians will impact you.

Secondly, I’d like you to start reading. You’ve got two options (ideally read both):

The Richest Man In Babylon - George Samuel Clason

Rich Dad Poor Dad - Robert Kiyosaki

Both of these books will help you get into an investor mindset, and understand the topics I’m discussing during this Basics series. Try and finish at least one of them in the next month.

Coming Up Next

Next week we shall be having the discussion on Assets vs Liabilities (that I would have covered today if it were not for my tangent)

The week after, I shall introduce you to my friend “Mr Market”.

If you enjoyed this week’s article, Like, Subscribe and Share! If you didn’t enjoy it, leave me some feedback in the comments below and I’ll work on it!

I’ll see you next week Investors!