Understanding the Business - Part 1

Does it lie within your Circle of Competence? Plus a portfolio reveal!

Dear Fellow Investors,

Welcome back! I’m Jay, a value investor, surgeon and PhD student. Today we’re finally starting a deep dive into Lululemon (LULU). I’m going to take you through my checklist in a multipart series.

The framework for my checklist is built mostly from what I learned from Phil Town. But there have been a few changes and adaptations based on what I’ve learned from other investors as well as my past mistakes.

N.B. We shall do a multipart series down the line about my mistakes at some point. I think you’ll enjoy my screw ups.

But before we begin let’s recap what we’ve covered so far. It’s important that you understand the concepts I’ve previously written about before you proceed as they provide the foundation for what we’re starting today.

1. A Touch of Narcissism

You learned why I started learning to invest in Origin Story Part 1 and Part 2. This is less important but may be useful for some of you if you’re trying to decide whether you want to start investing in the stock market yourselves.

2. Basic Financial Literacy

We covered The Origin of Money and Inflation, Compound Interest and Assets vs Liabilities.

3. The Irrationality of Mr Market

We discussed the origin of the irrational Mr Market, as well as why Mr Market behaves erratically. We concluded that as retail investors, we have the ability to take advantage of this foolishness to get rich.

4. Different Investing Approaches

We discussed conventional investing approaches and why value investors do not engage in it. Subsequently I gave you an overview of the value investing framework that Phil Town adapted from Charlie Munger and Warren Buffett.

5. Annual Reports and Financial Statements

I showed you where you can get financial data and how to read financial statements. The latter is crucial for the journey we are embarking on together.

6. Side Quests

I engaged in literary fellatio for Buffet’s birthday and introduced “cigar butt” vs quality investing to you. I also discussed one of the two companies I am actively investing into at present - Lululemon. Later in this article, I’ll explain to you why I’ve chosen to use LULU as an example to teach you rather than the other company.

Today we’re finally diving into the first part of the Value Investing Framework - Understanding the Business.

The Usual Disclaimer

How Do You Know What You Know?

Sorry, as usual I’m going to start with a rambling anecdote.

I did the International Baccalaureate in school. An important component of this was Theory of Knowledge (TOK) - also known as epistemology. While most people found these philosophical topics abhorrent, I thoroughly enjoyed it (because I’m a weirdo).

The very first question we were asked in my first TOK lesson is “How do you know what you know?” along with “what is learning?”

While I don’t intend to dive into a philosophical discussion here, it’s important to identify what your strengths and weaknesses are.

It is important to comprehend what you truly know and understand vs what you think you know.

A fatal flaw for many investors (including me!) is that we try to be clever and invest in businesses we don’t understand. This is often a recipe for disaster if the company is at risk of failing and you don’t understand why.

Here is a quote from Phil’s blog highlighting this issue:

‘Buffett often talks about jumping over “six-inch bars” instead of “six-foot bars.” The six-inch bars are the obvious opportunities — when a company you understand is on sale because the market panicked for reasons unrelated to its long-term value. Those are the investments worth making. The six-foot bars? That’s where arrogance leads you. And that’s where investors fall flat on their faces.’

-Phil Town

So all the investors who come from the school of Buffett and Munger ensure that when they are buying a business, it falls within their circle of competence.

Remember, in our investing framework that’s the first, and probably the most important hurdle we must clear:

We have to deal in things that we're capable of understanding.

And then once we're over that filter, we have to have a business with some intrinsic characteristics that give it a durable competitive advantage.

And then of course, we would vastly prefer a management in place with a lot of integrity and talent.

And finally, no matter how wonderful it is, it's not worth an infinite price. So we have to have a price that makes sense and gives a margin of safety, considering the natural vicissitudes of life.

It's a very simple set of ideas, and the reason that our ideas have not spread faster is that they're too simple! The professional classes can't justify their existence if that's all they have to say! I mean if it's all so obvious and so simple, what would they have to do with the rest of the semester?

- Charlie Munger

So, how do you know what you know? What falls within your circle of competence? Today’s entire article is going to be dedicated to this. We will continue with the rest of the checklist in the future.

Your Circle of Competence

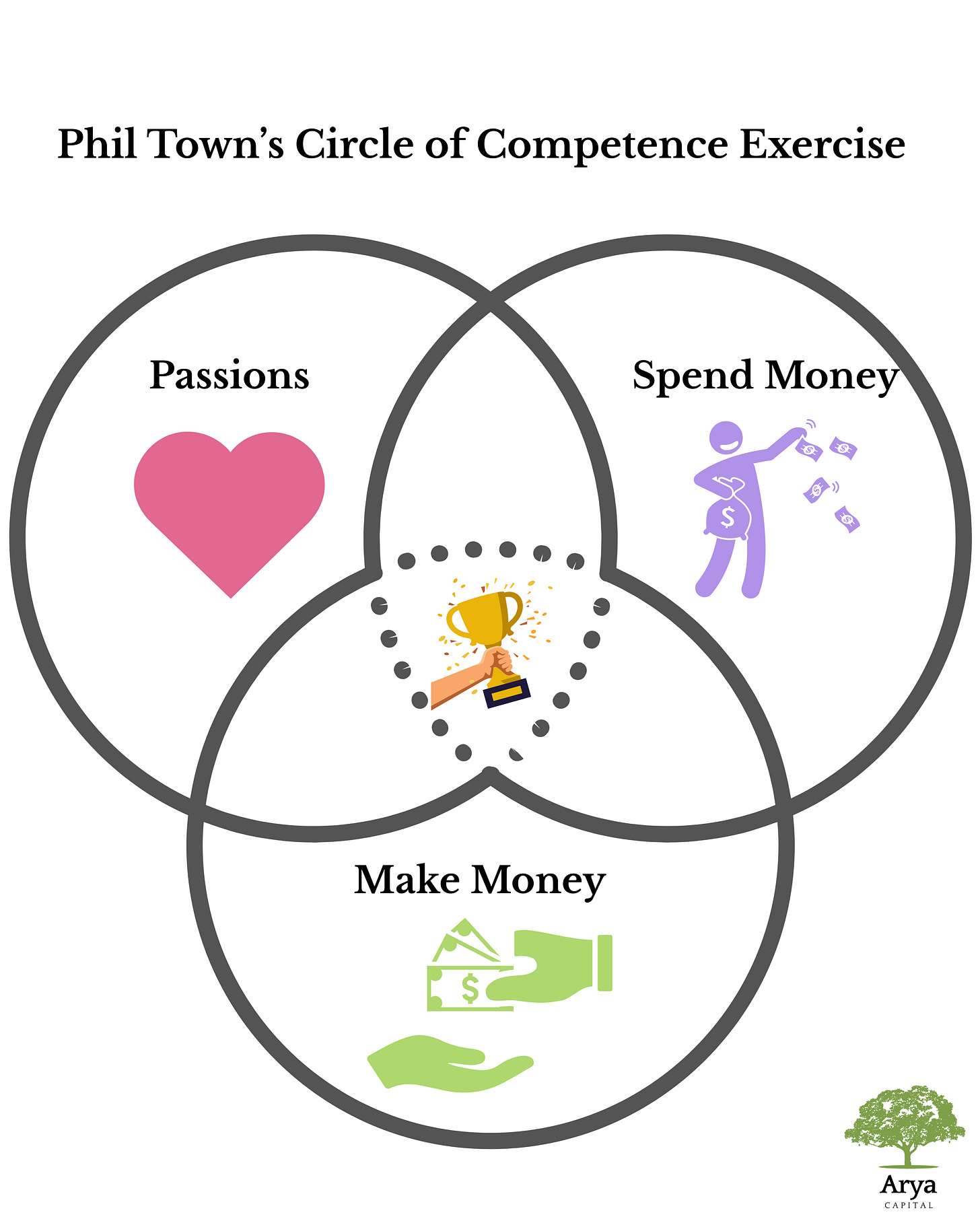

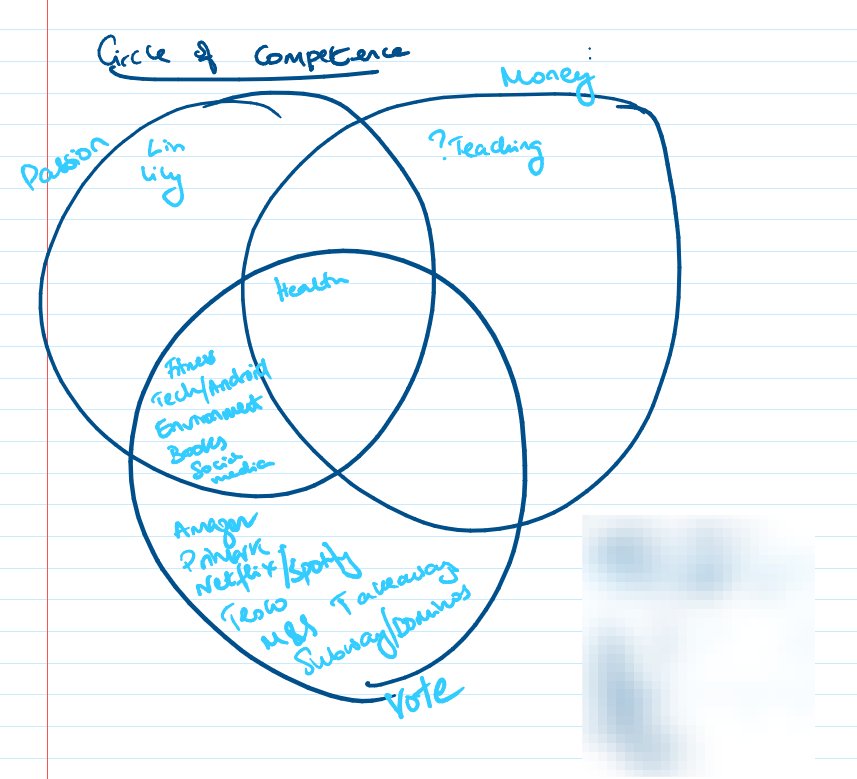

Well, Phil has an exercise which he discusses in his podcast, books and his course.

You must ask yourself 3 questions:

What am I passionate about?

What do I vote for with my money aka where do I spend my money?

Where do I make money?

Stop for a second, grab some pen and paper, and draw out the Venn diagram below.

Industries that lie in the centre are supposed to be the best for you to invest in, but that doesn’t mean you can’t invest in something that lies in only one of the three circles.

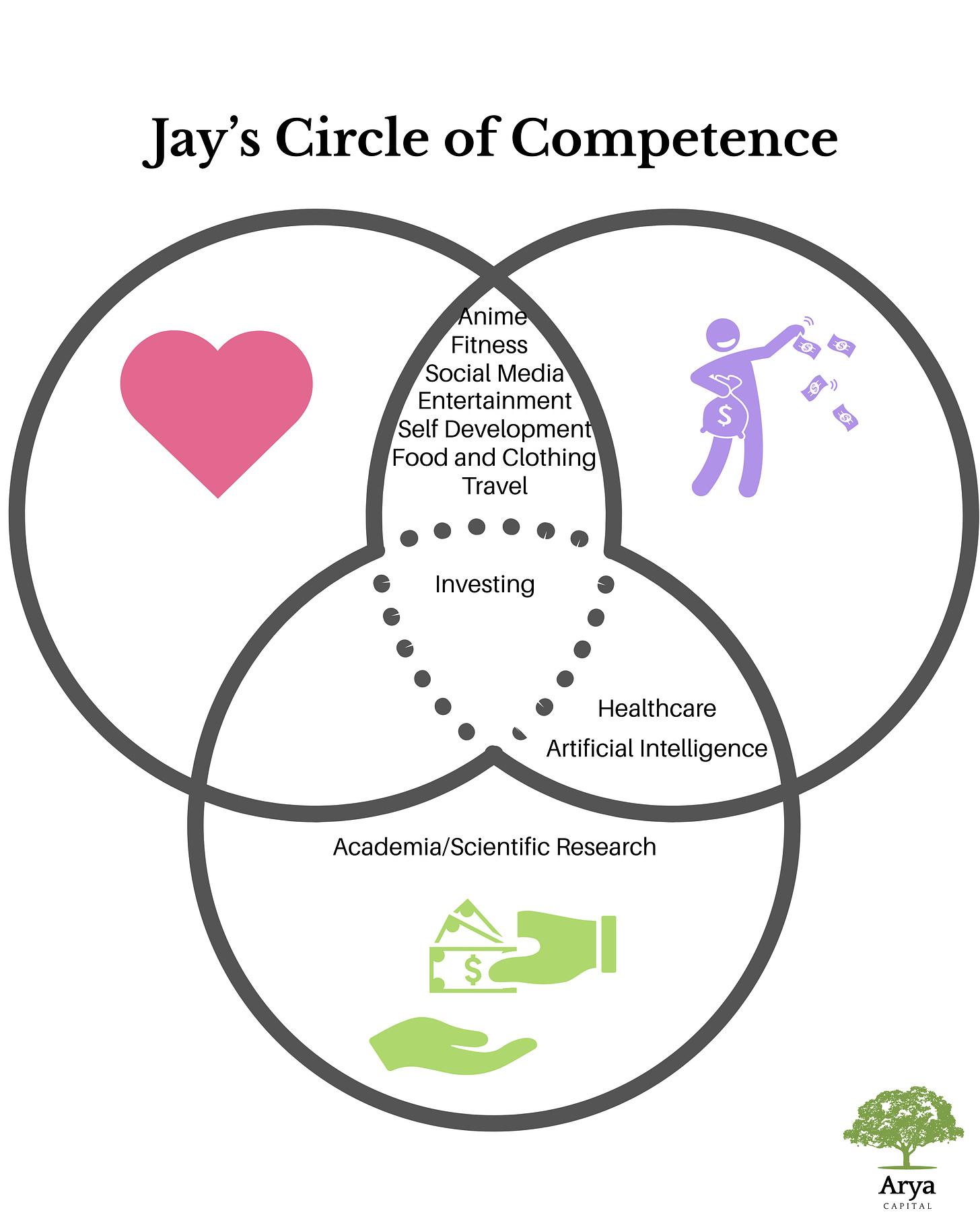

This is what I got the very first time I did the exercise in 2019 while listening to his podcast:

Funnily enough, even though healthcare was supposedly right in the centre of the circle, I discovered that it did not always lie within my circle of competence. I found that when digging into pharma companies such as GSK and AstraZeneca, I really struggled with understanding and following the companies.

Why? Aren’t I a doctor?

Well, the problem is I’m a surgeon. So I had zero knowledge about the latest chemotherapy agents or monoclonal antibodies that these companies were developing. I had no understanding of the conditions they were treating and could not keep up to date with latest developments. These diseases and drugs did not fall within my areas of competence.

As a dumb surgeon, all I was focused on was cutting people up. So perhaps I could focus on medical devices companies right? There are many that make cool vessel sealant devices or special haemostatic agents (stuff that stops bleeding). I thought I’d do well here.

Nope. I was wrong.

The real money spinners for most of these medical devices companies were devices for orthopaedic surgery or cardiac catheterisation. The handful of devices I was familiar with as a paediatric surgeon did not make much money for them and gave me no advantage in investing in these companies.

You see, none of these had any meaning to me.

And this is why Phil likes to call this first hurdle of understanding as “Meaning”. If a company or its products have no meaning to you, you’ll really struggle to follow and understand it.

It is however, possible to grow your circle of competence over time. You simply have to read voraciously and constantly learn.

And after 5 years of medical school and 9 years as a doctor, I finally found one healthcare company I can understand and is on sale: Novo Nordisk (NVO).

They’re the makers of Ozempic and Wegovy - the diabetes and weight loss drugs. But I’m not going to dive into NVO during this educational series.

Why?

Because, healthcare and pharma are hard. Even for me despite being a doctor.

So I’m using LULU to teach you as it’s a simpler business that more of you are probably capable of understanding.

And that brings me to the present day. My circle of competence has changed and grown, but only slightly.

Avoiding Hubris

It doesn’t matter how narrow your circle of competence is. It is much more important for it to be deep.

Many of you will be tempted to chase the AI boom and buy Nvidia or Oracle to make money. Afterall, Nvidia is now basically a household name after their recent performance in the market.

But tell me, how many of you know the difference between a Blackwell and an H100? What is CUDA? I bet most of you don’t even know what they are. And if you don’t, you definitely should not be investing in a company like Nvidia.

All of the naysayers (including my family and colleagues) told me I should not be investing on my own because it is “risky”. I should leave it to the professionals. But here is what Buffett has to say about risk.

"Risk comes from not knowing what you're doing."

-Warren Buffet

As you’ll discover below, all of my best investments involved companies I understood. My “failures” stemmed from from hubris and trying to invest in things I did not understand.

Thus, it’s important to focus on what you know and dig deep. Phil often says that your circle needs to be “an inch wide and a mile deep”.

“What an investor needs is the ability to correctly evaluate selected businesses. Note that word 'selected': You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital."

-Warren Buffett

For example, fitness, shopping, social media and entertainment/Netflix are all in my circles above from 2019. Even though they didn’t fit right into the centre, they were far easier to dig into than healthcare.

As a result, my first two investments were in The Gym Group (fitness), and Associated British Foods (Primark + Groceries). I made 80% and 40% returns respectively on each of these investments in just 1 year during the pandemic.

I then expanded into a bunch of other companies. Some did well and some didn’t.

Alibaba was a troublesome investment and I consider it a mistake. I’ll write articles on this down the line, but the primary issue was it wasn’t easy for me to understand. I eventually had some grasp of it, but not nearly enough. And it required a lot more effort than all the other companies I had.

But my hubris got in the way. I thought I could learn and understand anything and everything. As a result, after 4 years of holding the company, I only made a 30% return. Garbage compared to my other investments (but I suppose not too bad compared to just holding cash or following the market during that time).

Note that even though it was a mistake, I still exited with a profit. That’s the beauty of this investment strategy. If you do it right, your mistakes are on the same level as the best case scenarios of average investors.

I was so arrogant, that I even tried to dig into nuclear energy. Do you think I understand the first thing about it? I mean, it’s not impossible. I now know what HALEU is, but that means nothing to me. I just don’t have the time to fully grasp the industry and I can’t force myself to be genuinely interested in it. I’d realised that I’d crossed the edge of my competence and had to stop.

"It's not a competence if you don't know the edge of it."

- Charlie Munger

You have to accept that 9 times out of 10, you’re going to say no to an investment. Either because it’s no good or it’s simply too hard.

Warren Buffett famously has a box on his desk labelled “Too Hard”.

After reading about a company, he’d throw the paperwork in the box if he found he couldn’t understand it.

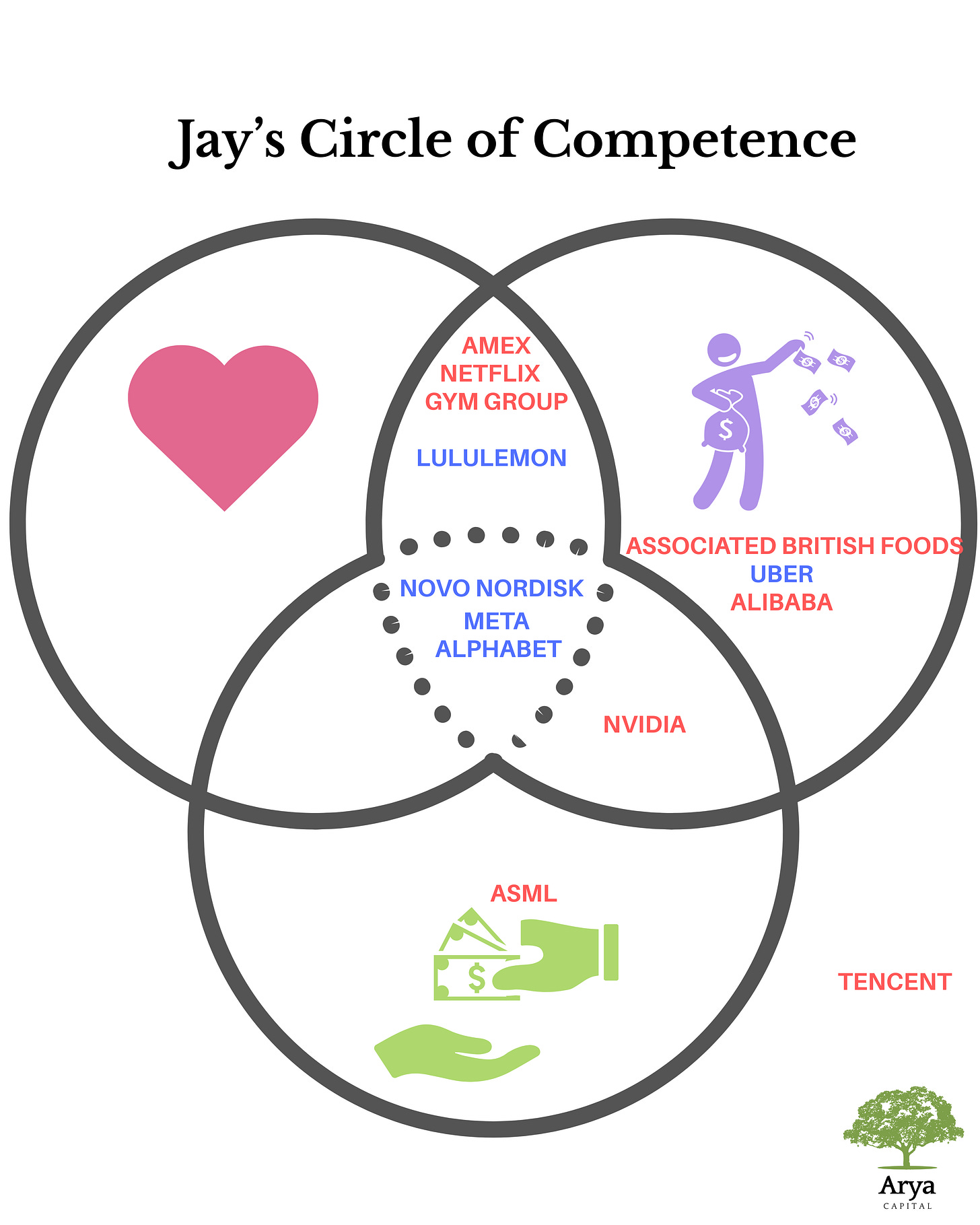

You can see how my recent investments fall within my circle of competence.

You’ll notice something interesting. I’ve sold out of Netflix, the wonderful investment I’ve been raving about for the last few weeks.

In fact, in the last week, I’ve sold out of 4 companies. Netflix, American Express, Nvidia and ASML.

Why?

To add to Lululemon and Novo Nordisk.

Duh.

I’ve cut my holdings down from 9 to 5. I’ve concentrated, not diversified (Remember Diworsification?).

Does this mean that I suddenly think those companies are bad? No. I made good returns on all of them, and I felt that they were either overvalued (Mr Market going manic for AI) or their growth may slow down in the near future. I’d rather sit safely in something I know is undervalued, will continue to have solid growth and I can easily understand.

Lets quickly go through them one by one so you can get a full picture.

American Express

Sold after 100% return to raise capital for current holdings (i.e. LULU and NVO)

I’m a customer. I have a Platinum card and thoroughly enjoy using it. The company has meaning to me. I bought during the 2022 panic surrounding inflation and rising interest rates.

Netflix

Sold after 500% return to raise capital for LULU and NVO. I’m a customer. I love most of the shows. And I really love how they’ve leaned into Anime. The company has meaning to me.

Gym Group

Sold after 80% return in the pandemic because this was a “cigar butt” investment. I was not confident about long term growth. I’m a former customer. They’re the second largest 24 hour gym provider in the UK, and I’m no longer their customer because I switched to one of their competitors (Pure Gym). I bought in 2020 when Mr Market believed people would never go to a gym again due to COVID. Absolutely retarded. People like me can’t work out at home. We manage our physical and mental health by finding heavy things to lift in a gym. And I hate cardio unless it’s with my wife (wink wink). This company definitely had meaning to me.

Associated British Foods

Sold for 40% return in the pandemic. Another “cigar butt” investment. They crashed because Primark did not sell clothes online during lockdowns. But as a customer of Primark and their grocery business, I knew that the company would survive due to the grocery business and demand for Primark would return post pandemic.

Meta

Current holding. I’m a customer. And I’m also the product (I’m being sold to advertising companies). I bought in 2022 due to a massive crash precipitated by TikTok, inflation and rising interest rates, and Zuck’s metaverse spending.

Alphabet (Google)

Current holding. Once again, I am both the customer and the product. Aside from interest rates rising thanks to inflation, ChatGPT came out in 2022.

Novo Nordisk

Current holding. Down 2% at the time of writing. I’m not a customer per se, but I have prescribed some of their products in my earlier years as a doctor when I rotated through medical specialities. They focus on diabetes and obesity which is far easier for me to understand. I bought in recently when it crashed due to concerns about competition. Funnily enough, it also falls under my passions not because I love healthcare, but because of weight loss and fitness (I’m a former fatty).

Uber

Current holding. I’m a customer. I bought earlier this year during the tariff tantrum.

Alibaba

Sold during April 2025 tariff tantrum lows for a 30% return. I originally started buying during the Chinese bear market that started in 2021 (hence my underperformance that year). I was not a regular customer. My wife and I use their Lazada platform in the Philippines to buy stuff for her grandmother once in a while. I don’t use or understand their other core Chinese platforms. And I spent 4 years bag holding the company for a “negligible” return. Despite the media narrative and bias, I was convinced that tariffs would hurt China more than the USA and decided to sell (this is a story for another day). Used proceeds to buy LULU and NVO.

Tencent

Again, bought during Chinese bear market and sold during the April 2025 tariff tantrum lows for a 60% return. I had previously trialled WeChat and played PUBG. But was not a customer when I bought or sold. I struggled to follow the company because I simply was not interested. Used proceeds to buy LULU and NVO.

Nvidia

Sold after 50% return to raise capital for LULU and NVO. I’m not a customer, I obviously can’t afford a Blackwell. But I engage in research pertaining to AI in healthcare. Despite the fact that I think they’ll continue to do really well, I sold because it was getting overvalued. I wanted to deploy the capital into something I understood better and was genuinely undervalued. The reality is that I have to work much harder to understand Nvidia than I do to understand LULU.

ASML

Sold after just making a 5% return to raise capital for LULU and NVO. I bought during the recent downturn precipitated by concerns about growth and tariffs. I had to work really hard to understand this company. They manufacture the machines that make the advanced chips that are then used for training all the cool AI models. I mean, it was challenging enough to learn about EUV lithography. But when they started talking about high NA EUV, I realised I had even more to learn and was struggling to keep up. When LULU dropped further, I decided to sell ASML to buy something undervalued that I could easily understand.

Lululemon

Current holding. After buying more as the price continued to crash, I’m down 24% at the time of writing. That’s a £7K loss . I’m sitting tight. I first saw the stock price collapse in August 2024. I was not a customer at the time, but I was interested as it seemed like something I would understand. As mentioned above, as a former fatty, I really do enjoy investing in companies related to fitness and exercise. I think it’s good for the world. So I took my wife with me to a store. We tried on their apparel. Checked out their competition. Watched reviews on YouTube, Instagram and TikTok. And I fell in love with it. The process of investigating the company as a potential investor actually turned me into a customer! I’ve now binned all my GymShark clothing and only wear Lululemon to the gym. You’ll hear more about this later in the deep dive series.

What’s the common theme? I’m a customer of almost all these companies. This gives me an edge over some Wall Street finance bro who has never used these products before. There is only so much you can learn on an excel spreadsheet.

"You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don't, you're going to lose. And that's as close to certain as any prediction that you can make. You have to figure out where you've got an edge. And you've got to play within your own circle of competence."

-Charlie Munger

Passion Wins

I found that being a customer means that you enjoy the product. You naturally spend money on it. And like gravity, you find yourself being pulled deeper into understanding it without having to try too hard.

Furthermore, many people aren’t actually passionate about their jobs. This can be because they never enjoyed it in the first place (just a means to an end), or they became disillusioned like I did. Despite actually making money through a career in healthcare, I really struggled with healthcare companies.

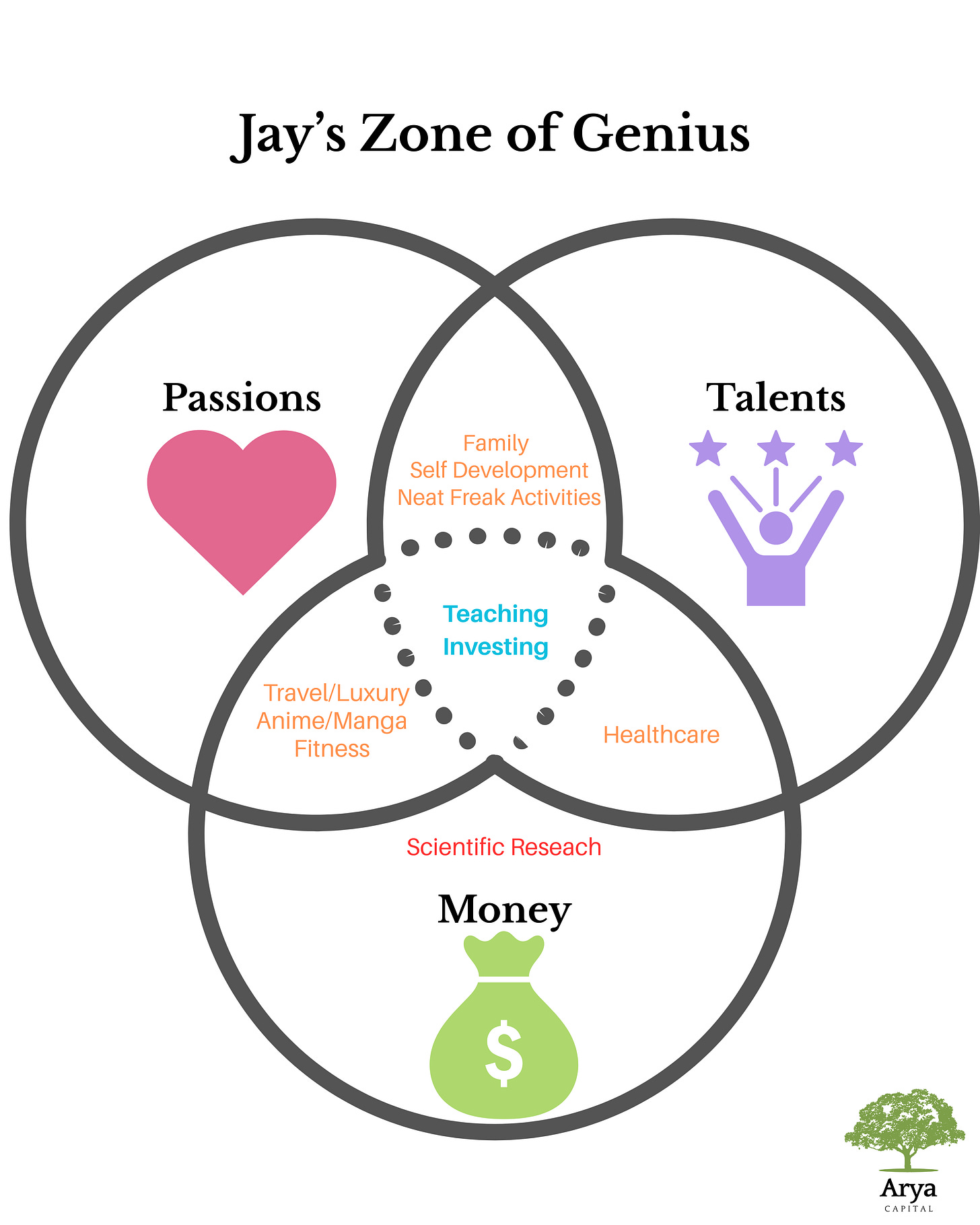

Interestingly enough, a few months ago I attended a coaching session where I was looking for career advice. I am seriously contemplating leaving healthcare. And the coach suggested a similar Venn Diagram exercise. The aim was to find my “Zone of Genius”, a field where I would enjoy the work, make money and thrive.

The questions I had to ask myself were:

What are my Passions?

What are my Talents?

What pays Money?

I’ve lost passion for healthcare, despite being good at it. Not only do I suck at science, but I also genuinely I hate it. I can’t really get paid for being a good husband, reading philosophy or being a organised and tidy at home.

I can’t draw manga, I’m not good at travel vlogging, and despite being passionate about fitness, I’m not jacked.

Thus I came to the inevitable conclusion about my future career pathway. Just lean into investing.

The beauty of investing is that it allows you to follow your passion no matter what it is. Are you a nerd you actually likes nuclear physics? Then sure, go ahead and invest in nuclear energy companies. Do you live and breathe AI chip design? Maybe you’ll like Nvidia, Qualcomm, AMD or Arm. Like wearing high quality, comfy but sexy clothes to the gym or yoga? Maybe Lululemon is for you. Spend ages on YouTube or Instagram? Maybe you want to look at Alphabet or Meta. Love travelling in style and luxury? You might be interested in American Express.

Passion wins. Find it. Build on it. Invest and Get Rich. Be Happy.

"Money can't buy happiness, but the absence of money can cause unhappiness. Money buys freedom: intellectual freedom, freedom to choose who you vote for, to choose what you want to do professionally."

- Nassim Nicholas Taleb

Homework

That’s it for today. We’ve only just scratched the surface into understanding a company. Your homework, is to figure out your circle of competence. Does Lululemon fall within it? It’s okay if it doesn’t, you can have a think about any other companies that might.

Next week, we’re diving deeper into how to understand a company using LULU as an example. This is the checklist we’re going to go through:

Does the company lie within your circle of competence? (completed today)

Can you describe the business in 1 sentence?

Can you summarise the business activities in 1 paragraph?

Any gurus buying or selling?

Do you know a problem the business solves for the customer?

Can you describe critical parts of its operation?

Who are the top 3 competitors and how they make money?

Can you describe the core customers in a sentence (ideally you)?

Are the customers in love/truly in need of this company? Is it easy to convince them to buy?

What are the Key Performance Indicators (KPIs)?

Is it a simple and predictable business?

I suggest you have a read and maybe try to work your way through it during the week for Lululemon or a different company of your choice.

Next week you get to compare your homework with mine. I’ll see you then